The only conversation topics that make investment managers squirm more than race and gender are fees and costs.

So if you’re one of them, this is your trigger warning.

Ashby and I began the latest episode of Free Money by discussing the fruits borne by a secret research project that took more than two years of work.

Led by Jennifer Eberhart, Ashby and several colleagues from Stanford and Illumen Capital surveyed professional asset allocators—people who back private equity and venture capital funds for a living—and found evidence of racial bias in their responses to hypothetical “one-pagers” from teams seeking to raise money for a venture capital fund.

So what?

Well, it’s more than just “people are biased.”

In the words of the study they published a few days ago in the Proceedings of the National Academy of Sciences (emphasis mine):

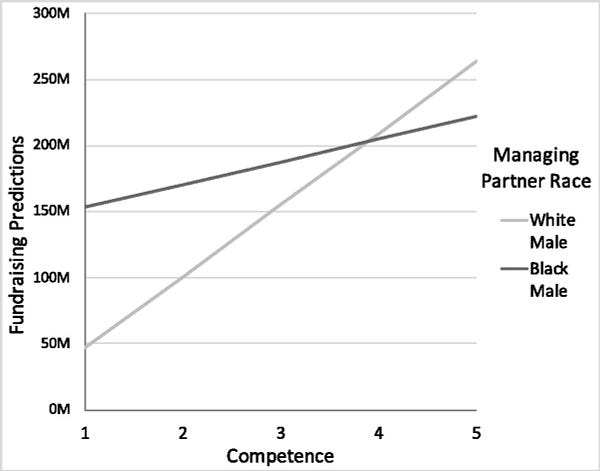

These results suggest first that underrepresentation of people of color in the realm of investing is not only a pipeline problem, and second, that funds led by people of color might paradoxically face the most barriers to advancement after they have established themselves as strong performers.

Here’s that in picture form:

We go into detail about how this research was performed and what it means on the podcast, then discuss fees and costs for good measure. You should listen to it, because I’m going to spend the rest of this post talking about why the lack of racial diversity in fund management matters.

At a high level, that’d be because it matters.

Monocultures of any sort are unnatural, unstable, and often self defeating. We certainly have one of those in investment management. At industry gatherings, cisgender white men wearing blue shirts and grey suits typically outnumber all other flavors of human put together.

And that’s lame regardless of what else is true.

But lots more is true. Think about it: we’re talking about bias in the process which determines who gets to invest in innovation. Venture capital investors are charged with choosing and backing entrepreneurs that are capable of changing the world…or at least an industry.

If allocator bias excludes talented teams that look different, what else are they missing? Which teams aren’t they backing? How many brilliant businesses did black and brown people never get the chance to build?

And of course: how can this be fixed going forward?

Awareness is a start.

This is far from the first time that racial bias has been found in professional environments. One paper that’s referenced in the study is enough to make anyone question the concept of meritocracy:

While highly qualified White candidates were 27% more likely to get a callback than less qualified White candidates, highly qualified Black candidates were only 8% more likely to get a callback than less qualified Black candidates. Thus, the payoff for strong qualifications is less for Blacks.

This is disconcerting at a micro level, but aggregate each instance of bias and it’s terrifying.

Especially if you’re new to thinking about it.

Bias means more than just unrecognized merit.

Black people get different medicine. So do women.

The above chart comes a study of how doctors—who are literally scientists—prescribe pain medication. Other work has found that white doctors hold false beliefs about the biological differences between black people and white people.

For instance, forty percent of first year medical students surveyed believed that black people had thicker skin than whites. Though the proportion improved with training, twenty five percent of medical residents (i.e., med school graduates) surveyed still held this mistaken belief.

It gets weirder. Another survey found many whites explicitly believe blacks are capable of superhuman feats like withstanding the heat of hot coals, running faster than a fighter jet, and falling from an airplane without breaking a bone.

This is perplexing.

I used to teach writing seminars to investment professionals fairly often, and I always asked them to write short essays about which fictional character would make the best portfolio manager.

Naturally, I’d gather data on who participants chose to write about. The chart above comes from a seminar at a large global asset manager, and is fairly typical of my (not peer-reviewed) experience:

Exactly half of the responses are superheroes from the Marvel or D.C. universe.

Less than ten percent are feminine coded.

Every human-like character is white.

Batman—who would make a terrible portfolio manager—gets most of the votes.

So I guess superhuman qualities are seen as desirable in portfolio managers, but only when white people have them.

And to be clear: that’s the point.

The asset allocators surveyed in the PNAS study I talked about earlier predicted that top quality black teams would raise less money than top quality white teams, but also that the least qualified black teams would raise three times more money than the least qualified white ones.

So why do minority-owned firms manage a small and shrinking slice of the world’s investment capital? The chart above just measures mutual funds, but is certainly indicates an industry-wide reality.

It’s hard to say for sure. Ownership is far from the only relevant indicator of diversity in investment management. The entire business is under pressure. Firms are merging left and right to stay competitive, and index funds are swallowing up an ever-greater share of industry assets under management.

But maybe part of it is simple: bad money drives out good.

Copernicus said as much. So did Aristophanes. In economics, it’s called Gresham’s law: If two forms of a commodity are accepted at similar face value, the more valuable form of that commodity will gradually disappear. It’s not the whole story, but the point here is that black faces get assessed the same way regardless of their value.

That’s a process issue. And it’s lame no matter what else is true.

Was this worth reading? Don’t miss the next one.

Here are a few other things we mentioned in the podcast:

A PNIS article about racial representation in New Yorker cartoons.

The article Ashby and I published in 2018 which gathered some of the data for this survey.

A piece I wrote about what to call your fund after learning about the field of onomastics.

And those sweet flying taxis that take off and land vertically.

Race, Gender, Fees, And Costs